Blockchain Explained — Simple, non-technical guide for beginners

What it is, why nodes matter, how tokens work, and practical tips before investing

What is a blockchain? (short answer)

Think of a blockchain as a shared digital notebook. Many people keep copies. When someone adds a new page of transactions, everyone updates their copy. That shared record is hard to change once it’s written, so it helps people agree on what happened without needing a single middleman.

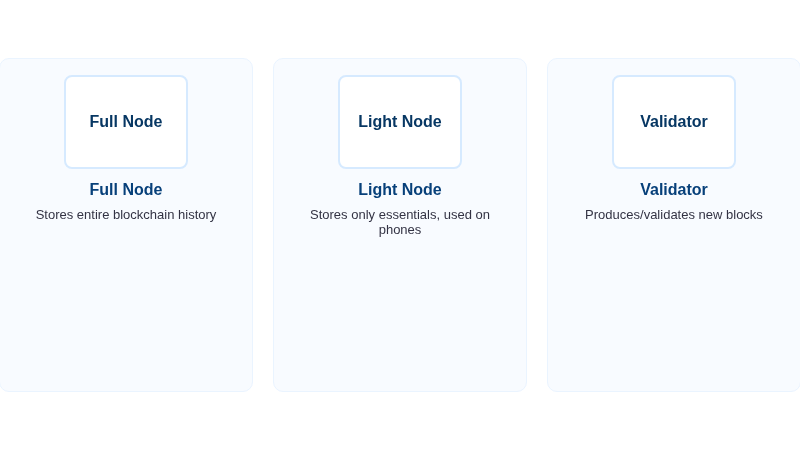

Nodes — who keeps the notebook?

Nodes are the computers that store and share the blockchain notebook. Some nodes keep the whole history (full nodes). Others keep only the essentials (light nodes). Special nodes help add new pages (miners or validators).

Why nodes matter: the more independent full nodes there are, the harder it is for anyone to rewrite or censor the record. Nodes also validate transactions and relay data so the network runs smoothly.

Tokens — what are they?

A token is a digital item recorded on a blockchain. Tokens can represent currency, access rights, unique digital items (NFTs), or governance/voting rights. Native coins (like Bitcoin or Ether) often pay for transaction fees and reward people who run the network.

Why tokens have value: value comes from usefulness or scarcity. Token rules (supply, distribution, and how they’re used) affect whether people want them.

Quick note on consensus

Consensus is how the network agrees on the next page to add. Common methods include Proof of Work (miners solve puzzles to add blocks) and Proof of Stake (token holders lock tokens and are chosen to validate). Each method has trade-offs around energy use, speed, and decentralization.

Investing basics: what beginners should know

Blockchain investing can be exciting but risky. Keep these practical rules in mind to avoid common mistakes.

- Do your homework. Read the project’s plain-language explanation and check the team and roadmap.

- Check token utility. Is the token necessary for the product to work, or is it speculative?

- Beware of hype. Headlines focus on big returns. Look for real adoption and users.

- Limit exposure. Only invest what you can afford to lose; avoid over-concentration.

- Protect your assets. For significant holdings, use a hardware wallet and enable strong security on exchanges.

- Understand fees & liquidity. High network fees or thin trading markets can make moving or selling tokens costly or hard.

Common beginner mistakes

Main pitfalls: FOMO buying, storing large balances on exchanges long-term, falling for “guaranteed returns,” ignoring tax rules, and not double-checking contract addresses before approving transfers.

Practical first steps

If you want to try blockchain safely, follow three simple steps:

Learn before you buy

Read clear guides, watch explainer videos, and follow reputable docs.

Try a tiny experiment

Send a small transaction, pay the fee, and use a simple app on a test network.

Secure your keys

Use hardware wallets for long-term storage and keep offline backups of seed phrases.

Quick glossary

Blockchain: a linked chain of data blocks stored across many computers.

Node: a participant computer in the network that stores or validates data.

Token: a digital asset recorded on a blockchain.

Native coin: the primary currency of a blockchain (e.g., BTC, ETH).

Smart contract: code that runs on a blockchain and performs actions automatically.

Gas: transaction fee that funds validators/miners (commonly used on Ethereum).

Wallet: software or hardware used to hold private keys and interact with tokens.

Final thoughts

Blockchain is a powerful foundational technology with real use cases, but the space mixes engineering, early-stage business models, and heavy speculation. If you plan to build, use, or invest, take time to learn the basics, verify claims, protect your assets, and treat token opportunities with healthy skepticism.